Industry Thought Leadership

9 Circles of Hell RGK Fraud Control System

November, 2017

Vendors of the largest anti-virus companies know perfectly well that the fight against fraud, malware is always a catch-up game. In the field of mobile payments, things are exactly the same - an endless arms race, where even a crushing victory gives only temporary results. In such circumstances it is necessary to think/act outside the box.

Today RGK Mobile is in the forefront of successfully fighting fraud and that’s thanks to our original intelligent system of fraud control. We look to the future, fully understanding that the long-term stabilization of the VAS market is possible only with an integrated approach to the issue.

The results of the system with this approach are more than impressive: up to 70 per cent of fraud traffic is detected preventively (proactively), more than 25 per cent is detected in a period of several minutes to several hours, followed by training for preventive (proactive) detection.

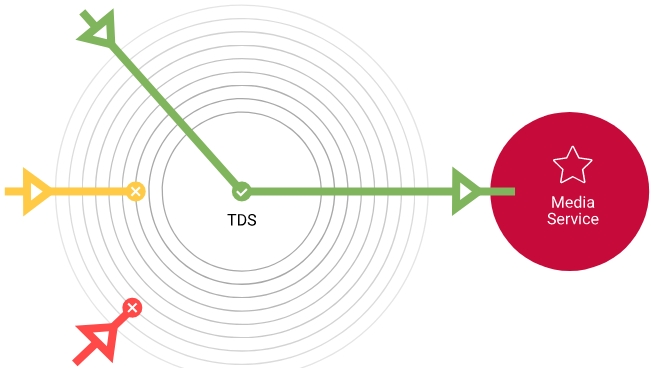

Before gaining access to RGK Mobile’s media services, any visitor faces a system containing 9 levels of protection and control using neural networks and machine learning. Let’s talk about the methods we use, in greater detail:

- Checking for the number of media service subscriptions. The check is conducted at the TDS level. With the access to the MSISDN at the TDS level, the check will also be conducted by volumes. If there are several subscriptions for a short period of time, the user will be prevented from accessing to the payment page.

- Manual filtering of applications. Our specialists manually find the features of the transmitted click’s parameters, which allow us to determine the source as an autoclicker application or a malware/adware locker application, before entering the landing page. Thus, we remove up to 80% of the traffic described above.

- Basic fraud checks. Several parameters, well-known to specialists, are being checked including: the time of click and other special elements that usually hint at bot activity, as opposed to an ordinary user. In case we are not sure about the traffic stream’s quality, we send a portion of it to an additional verification page-layer (pre-landing), which requires a simple and obvious action from the user to continue. This allows us to detect autoclicks with very little loss in conversions.

- Original automated monitoring system. The system makes automatic and manual collection of advertising materials from leading sources, into a CMS, using real devices equipped with conventional SIM cards and located in more than 30 countries; the operators then perform detailed analysis, manual monitoring of cases of interest and, as a result, make their recommendations on the investigated traffic flow. The results are also provided to operators as an assistance in regulating their perspective market.

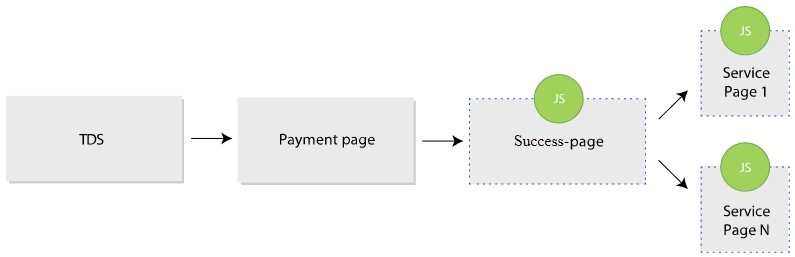

- Payment page integrity check. In cases where the payment page is hosted by RGK, and also in cases of special agreements with the operator, we perform a mandatory comparison of the original page with the one that the user finally sees. The goal is to recognize the introduction of malicious JS code. Inconsistencies between the two are usually a sign of fraudulent activity.

- Blacklists. Based on all the filters described, blacklists of sources are created, joined by subscriber blacklists, in case of an agreement with operator.

Fraud Control AI. This point is considered in more detail as this is where several methods are combined into one intelligent system.

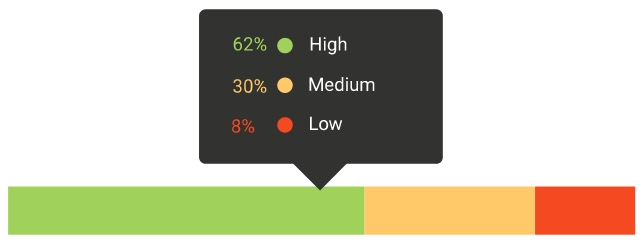

Fraud Control AI is a tool for detecting low-quality and fraudulant traffic, based on analysis of user behavior in comparison with conversion rates, churn rate, number of subscribed services, rebilling and complaints.

By posting a JS script on both payment and service pages, we collect information about the user’s behavior including clicks, page depth navigation, scrolling, finger movements across the screen, use of media content, and more.

Then, based on the available indicators, we manually identify the main negative behavioral patterns, across different types of traffic. Further, these patterns are embedded into a specially- programmed neuron network, which continually evolves, based on data collected from tens of millions of visits per day.

Current result: preventive detection of up to 70% of fraud traffic, a definite success, by industry standards.

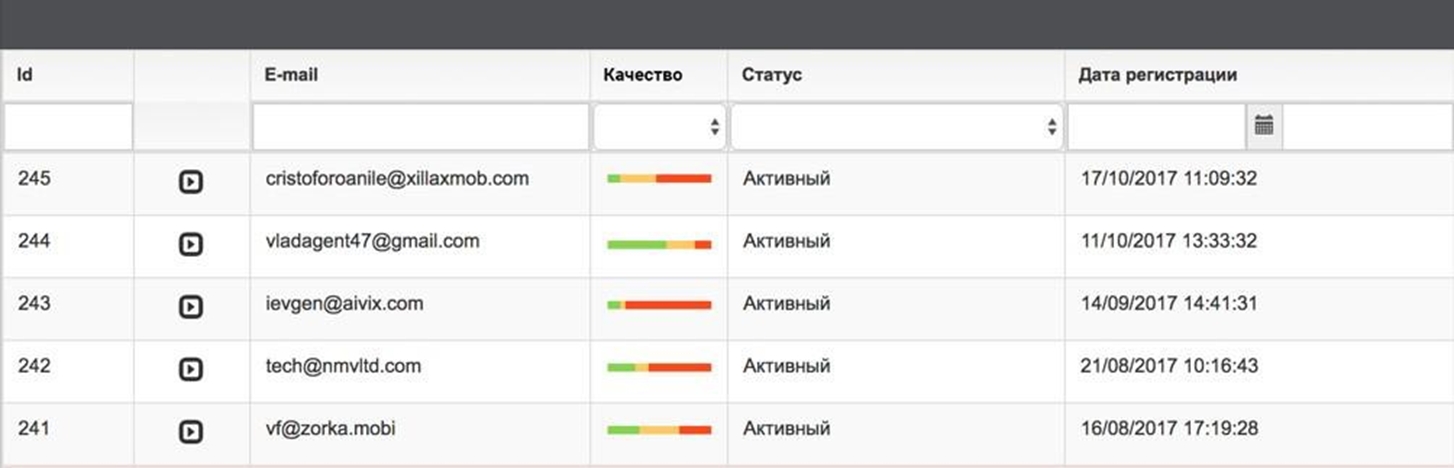

Partners Management. All managers of the company and our platform distributors have clear instructions on mandatory verification of traffic sources. Information on accounts of unscrupulous partners is stored in a unified database. Through a quick scan of system settings and configuration, IP addresses, requisites and other data, we are able to identify and prevent registration of potentially- malicious partners.

Customer Care. The work of our support service and its involvement in fraud detection and prevention has been described in the past in detail, in an article called Protecting Subscribers against Fraud. All of our local call centers are integrated into a unified RGK Engine, a platform that manages complaints, all broken down into categories, related to specific traffic sources.

This allows us to monitor, in real- time, what traffic flows cause issues and identify the type of the issue and its actual urgency. The reaction is carried out in both automatic and manual modes.

Combining those 9 methods together, we are able to accurately evaluate the quality of the various traffic sources, partners and services; internally, it allows us to score the quality of our own RGK Engine distributors. Indicators are identified quickly and can be reacted to swiftly, if necessary.

RGK Mobile’s integrated approach to one of the most urgent issues for operators, in the field of VAS today, has demonstrated high efficiency and significant results. Continual monitoring allows for long-term stability of the mobile commerce market using DCB. The full- automation of the anti-fraud system, combined with human-monitoring allows RGK and its operator partners the opportunity to focus on the quality of services offered to subscribers, rather than playing the never-ending cat and mouse Fraud game.