Industry Thought Leadership

Mobile Money: Driving Growth in Times of COVID19

May, 2021Globally, large parts of the population suffer from financial exclusion as traditional banks fail to provide sufficient coverage. With mobile money as a solution, telcos have risen to the challenge. They are ideally positioned to capitalize on the growth opportunities associated with it. They are already trusted brands with a large customer base and broad geographical reach. Moreover, telcos can let mobile money services practically “piggyback” on their existing infrastructure, leveraging cost advantages that cannot be matched by any bank. And since many services can be delivered remotely, they are less dependent on having physical presences such as branches or ATMs.

With the recent COVID-19 outbreak, the benefits of mobile money have become even more apparent. While many economies have ground to a screeching halt due to shutdowns and the restriction of public life, mobile money has proven to be a lifeline for many businesses and private individuals.

Households enabled to make contactless transactions

The major benefit of mobile money, especially during the pandemic, is the ability of users to perform transactions remotely and contactless when the only alternative would be cash payments. According to a study by the World Economic Forum, high mobile phone penetration rates in the SAMENA region and the much more extensive availability of mobile money agents (228 per 100k people) vis-à-vis bank branches (11) or ATMs (33) globally lead to many people gaining quick access to remote paying services at a crucial time.

Government enabled to provide social assistance efficiently

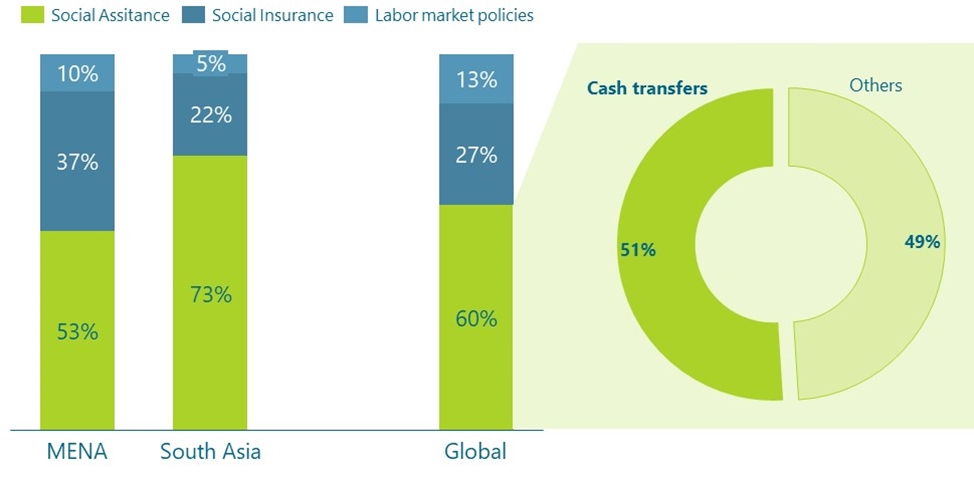

Another big contribution of mobile money during the pandemic was the ability of governments to wire cash benefits to large number of households. Handing out the benefits in cash requires significant resource effort while traditional bank transfers would have left out a large portion of recipients of these government programs which were at the forefront of governments immediate reactions to the economic downturn as shown by illustration 1. As an example, the Moroccan government released a statement that informal workers in Morocco were able to receive government aids quickly and efficiently using mobile money.

Illustration 1: COVID-19 Government responses, Source: World Economic Forum

Telcos response with customer favourable terms enabled steep adoption

Safaricom, the largest telecom operator in Kenya, reduced usage fees on East Africa’s leading mobile money solution, M-Pesa, shortly after the outbreak of COVID-19 in March 2020. After meeting with the Central Bank of Kenya, Safaricom explored new ways of increasing mobile money usage to reduce the risk of spreading the virus through physical cash. In addition, the company removed the daily transaction volume to encourage cashless payments and to support the Kenyan population during the pandemic.

Middle East experienced a boom in the number of mobile payment services during the pandemic as well. Telco operators such as Etisalat launched their new mobile wallet, available in 17 of its global operations. As the trend towards mobile money services increased in 2020, other telco operators such as Telkom, MTN, and Vodacom responded to the COVID-19 pandemic by lower fees, offering new credit services, and expanding of mobile payment networks among the key responses to COVID-19 in the SAMENA region.

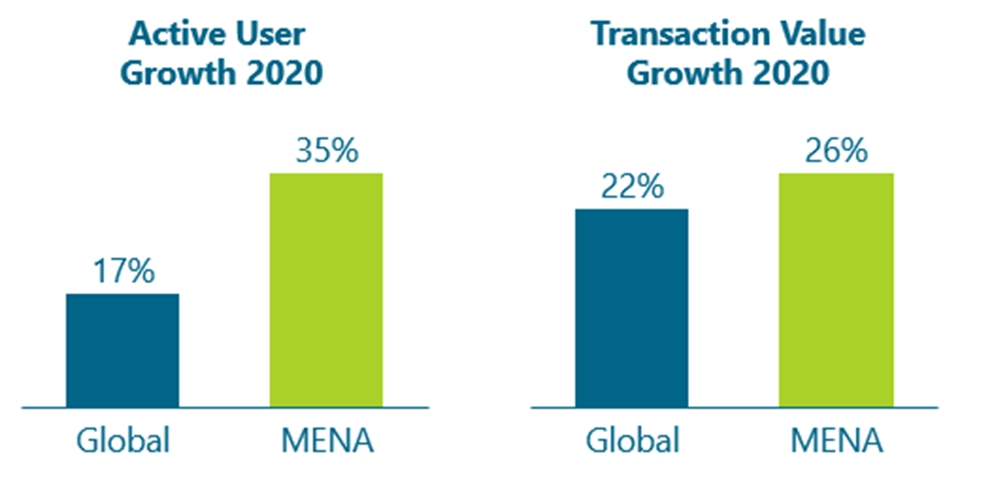

Ultimately, mobile money experienced some breath-taking growth in the SAMENA region in 2020. Particularly the MENA region has seen significant uptake in active accounts and transaction value compared to the global growth.

To grow the mobile money business further, goetzpartners has identified several success factors for operators to gain a competitive edge in the market.

Building a dedicated mobile money salesforce

Today already, most telcos in mobile money markets have dedicated sales forces, called mobile money agents. Often traveling in teams, mobile money agents cover large parts of the country, targeting highly frequented locations such as weekly markets or the large cities' main streets. Rather than trying to lure people into shops, deploying such sales teams is much more effective because they go where the crowds are and directly engaging with (potential) customers.

Adjusting to a new low-fee environment

Many players waived their fees altogether or were mandated to do so by government legislation to support the local economy and grow their business at the same time. As many customers may have now grown accustomed to low or no transaction fees, telcos should adapt to these new conditions and extend the low fees beyond COVID-19 restrictions and instead look for other ways to monetize their systems by offering additional services surrounding mobile money.

Illustration 2: Mobile Money Growth, Source: GSMA

Offering superior recharge conditions for prepaid top-up via mobile money

The provision of superior recharge conditions for airtime top-ups via mobile money is another powerful incentive. Benefits are typically granted in the form of multipliers on purchased airtime (e.g., receive double the data/ airtime for a given recharge value) and are very effective when it comes to converting existing mobile customers to mobile money.

Building an attractive ecosystem of diverse partners

Operators needs to build an attractive platform, including favorable pricing conditions and standardized API that allow partners to connect easily and at minimal costs. It needs to Actively recruit a diverse set of partners including merchants, employers, government agencies, banks, and even other telcos. With the addition of every new customer, the value of the network increases, eventually unleashing powerful exponential growth.

Given the steep uptake in active accounts driven by the COVID-19 pandemic, it is now a crucial time for telcos to ride the wave and leverage it to accelerate the reach and growth from this offering.