Industry Thought Leadership

Digital CSP Roadmap for the Middle East

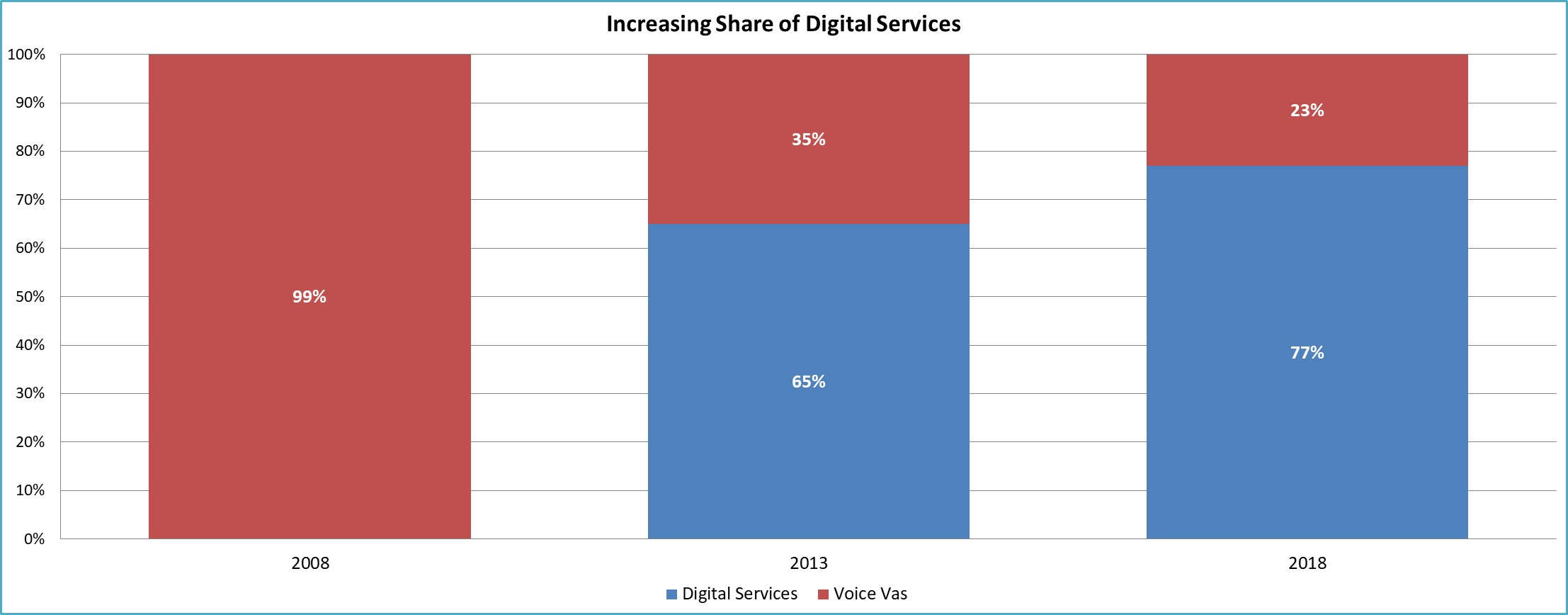

September, 2019The Middle East provides a study in contrast. While the GCC states and Northern Africa have subscriber penetration of 77% and 74% respectively, in the emerging countries subscriber penetration is as low as 48%. Similarly, while smartphone penetration in GCC countries is as high as 74%, it is merely 49% in North Africa and 39% in emerging economies. Gulf Cooperation Council Countries have embraced digital services. UAE, Bahrain and Kuwait have higher contribution of digital services (Bahrain - 8% of GDP). Countries like Egypt, Lebanon will soon catch up and increase digitization of the region. GSMA forecasts that by 2025, North Africa and the emerging economies would have caught up with the GCC countries with regards to smartphone and subscriber penetration.

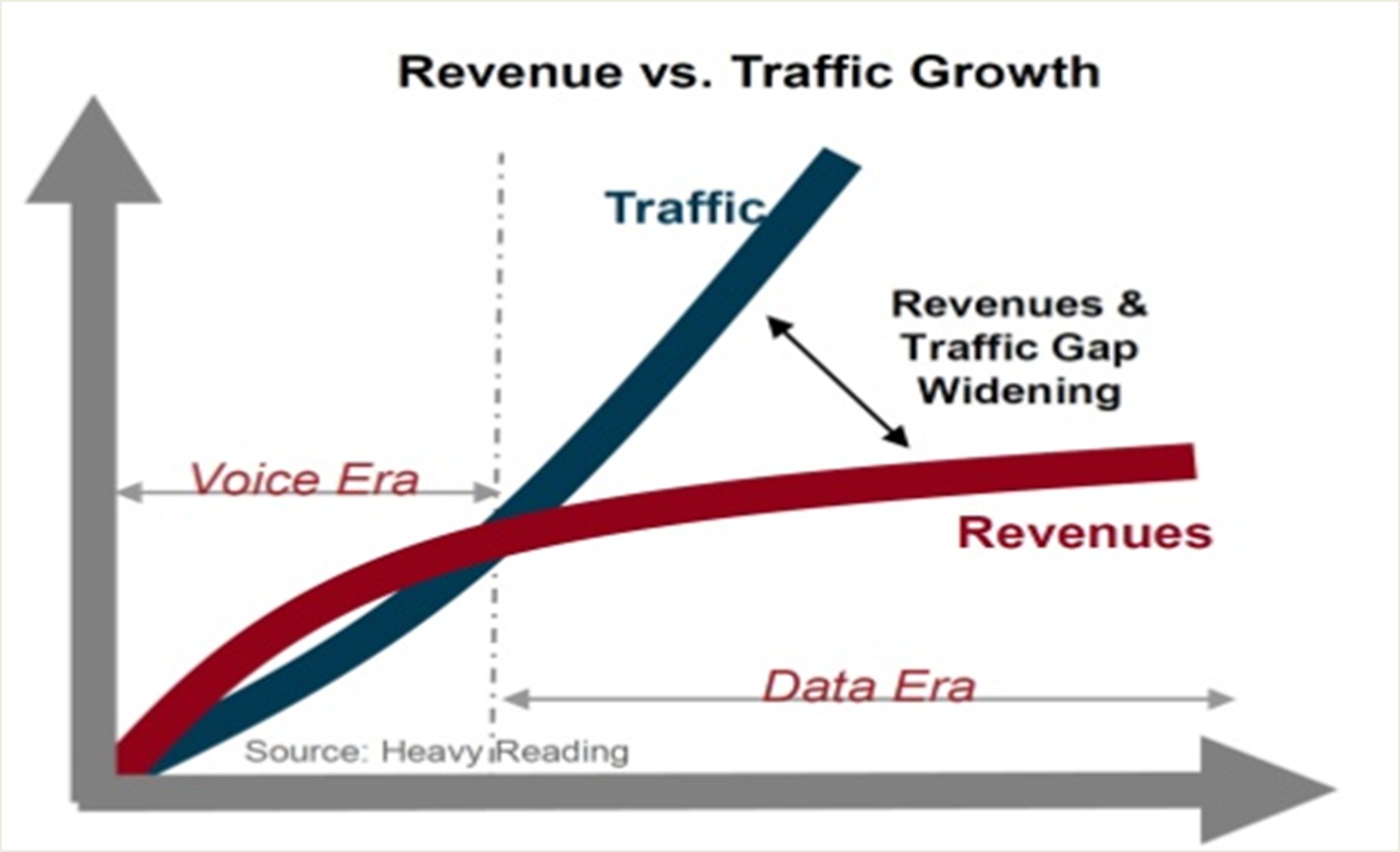

The coming saturation in the MENA telecom space is already witnessing price war, which will eventually lead to the inevitable commodification of telecom core services. Due to this commodification, the revenue forecast is very modest for the region – a CAGR of 1.8% between 2017 -2025 (GSMA Mobile Economy, Middle East 2018). As the decoupling between the operator traffic and revenue becomes stronger in time, telecom companies will be under tremendous pressure to stay relevant in a rapidly changing world.

Some of the key current and future MENA telecom challenges are:

Commoditization

If telecom companies are unable to halt the trend towards commoditization of data, they risk becoming data pipes to their faster and more nimble competitors.

Disruptive Competition

Traditional telecom services, such as voice and messaging, are being disrupted by faster and more nimble competitors resulting in revenue losses for the operator.

Rise of the new digital customers

Today’s digitally savvy customers are used to the customization and personalization provided by digital leaders like Google, Facebook, Amazon, & Netflix and so on. In this new battleground for the customer’s wallet and mindshare, the telecom companies will be measured against digital leaders like Google, Amazon or Netflix.

Lack of agility

Although telecom companies enjoy ubiquity in reach and deeper customer understanding through customer data they have not been able to match up with the pace with which OTT players cater to latest digital trends.

Leap from traditional CSP to digital CSP

In view of these challenges, it is time for Middle- East telecom companies to reimage their business lines along digital lines and pivot for the digital future. As the battle of customer attention as well as their wallet gets underway, telecom companies will have to take the leap of faith and transition quickly to digital CSPs.

Digitalization impacts practically every aspect of the business, be it payment instruments, digital services partner eco-system, sales and distribution channels and most importantly subscribers or should we say consumers of telco and non-telco services. All of these necessitate the need for enabling and on boarding the digital services partners, who may or may not be tech savvy, thereby requiring easy to integrate “Partner Management System APIs”.

We envisage that more and more partners will come on board with multitude of services, which would require creation of different products to be offered to the customers, thereby a robust and flexible “Product Catalogue System” becomes absolute must.

More service combinations would require Telcos to have robust systems in place for making consumers aware of these by innovative Campaign Management Systems and service discovery systems, with more and more personalization happening using AI/ML.

New age digital interfaces in social media will be used for customer acquisition also in addition to promotions today, this would need Subscriptions Management and Billing/Charging systems to support these interfaces for Customer Lifecycle Management.

Going forward even Customer Care Systems would need to interface with Social Media interfaces to be able to serve the customers on the interfaces of their choice.

Similarly service delivery systems will also need to evolve to support new age Digital Services partners and content/service delivery by use of new age technologies in AI/ML, AR/MR/VR, Facial Recognition, low latency simulcast, multi-player gaming or eSports etc

Similar capabilities will be needed in the backend systems mentioned above to support smart speakers, which will be another channel that customers of tomorrow will use heavily for their needs.

Digitalization will play a big role in managing Sales and Distribution system much more effectively for real time tracking of sales, inventory, new product launch, effective utilization of feet on street and incentivization of the channels.

Traditional CSPs who have succeeded in making the digital pivot will have the same set of unique digital capabilities that are the cornerstone and hallmark of success in today’s digital ecosystem.

Making the transition

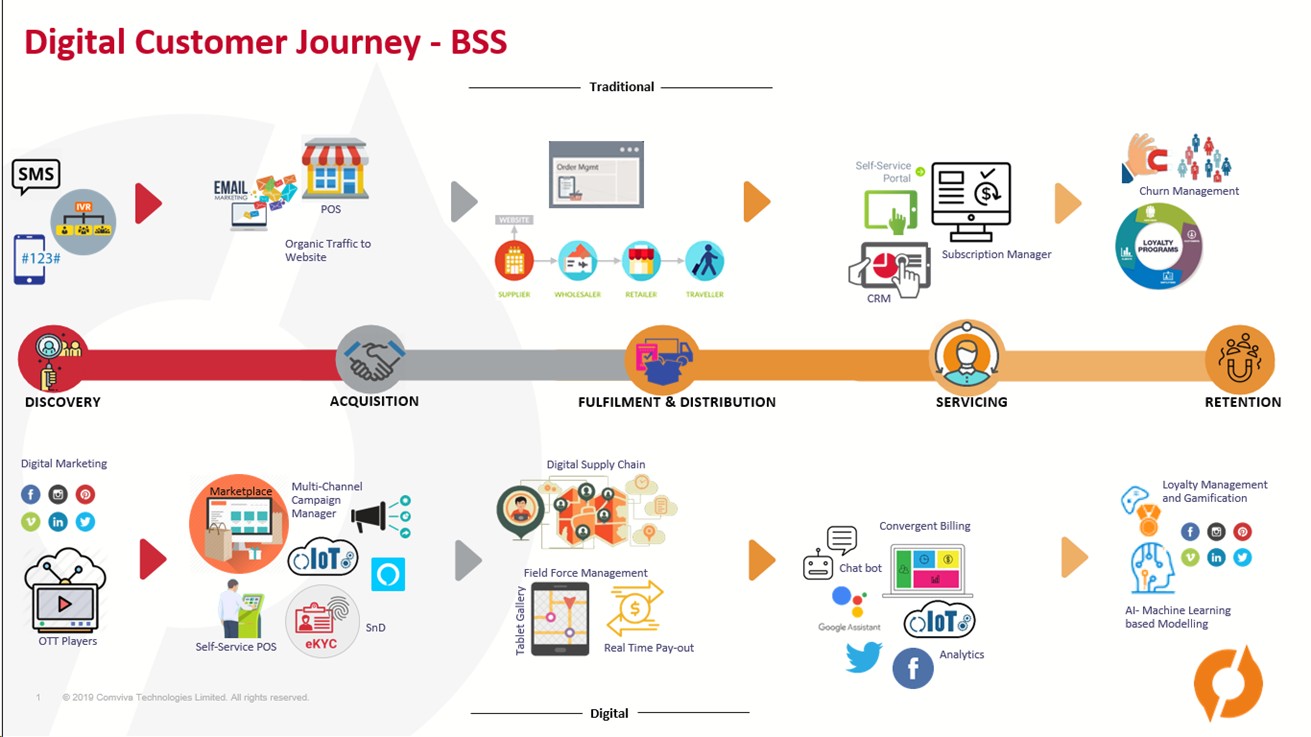

One could approach this transition in two different ways. Firstly, replace existing legacy systems with a robust digital core allowing the operator to offer digital services just like any other digital service providers. Since this approach will be driven by big ticket investments, and a long gestation period, the operators will’ve to assess their risk appetite as well as market conditions before committing to such changes. The other way to make this transition is to wrap the legacy telecom systems and processes with new digital capabilities as well as new digital thinking which will catalyse them into digital service providers. In order to make this transition the operator will have to bring digital transformation across its entire telco value chain consisting of discovery, acquisition, fulfilment & distribution, servicing and retention. Secondly, it will have to put the digital enablers in the backend for making the digital transition. So, it will need a renewed building blocks (discovery, acquisition, fulfilment, servicing, retention), as well as digital enablers to magnify BSS capabilities.

Building Block for CSP transformation

For many years SMS, IVR, & USSD were the primary channels for discovering new services. The popularity and high open rates of SMS allowed telecom operators to push messages on the basis of some predetermined rules or triggers based on context. Similarly, IVR provided a convenient way to search operator databases for information. USSD also provided a medium to the customers to extract information from telecom databases with hash codes.

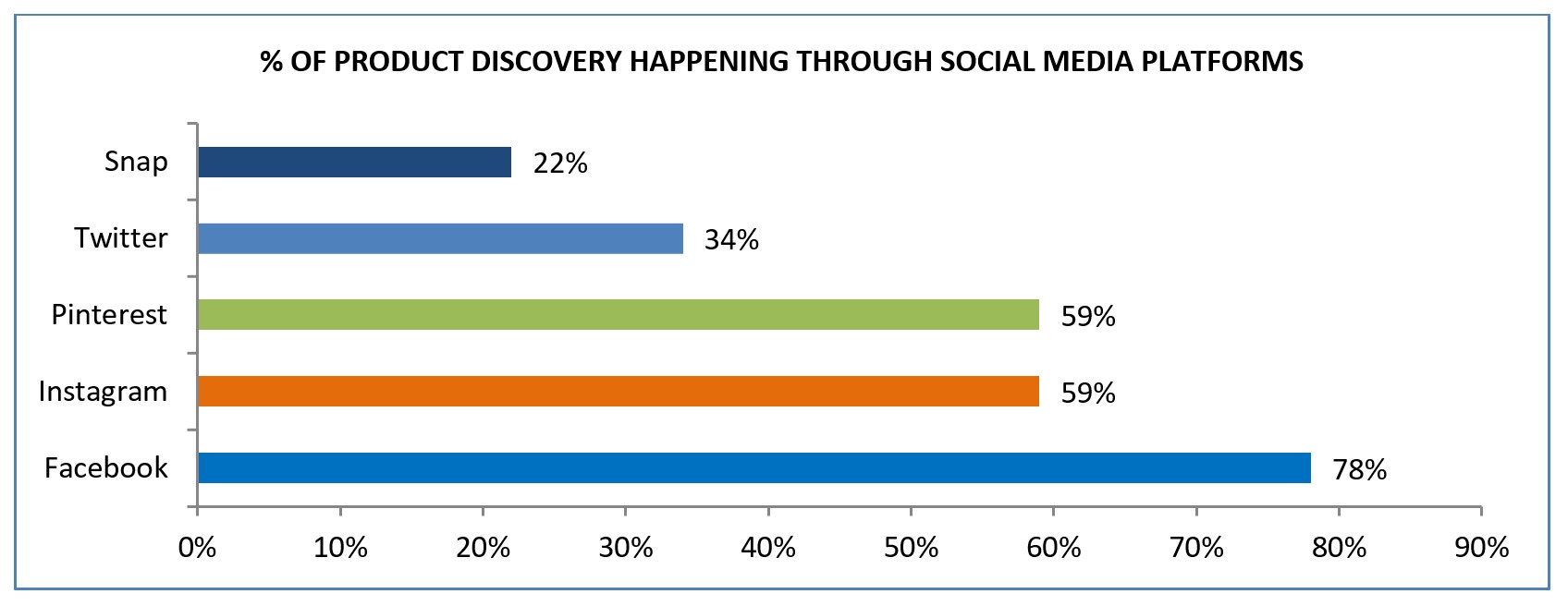

However, with MENA customers spending more time on social channels like twitter, Facebook, Instagram, telecom companies are realizing very quickly that they can no longer depend on these traditional channels for driving customer engagement. To understand the shifting nature of customer engagement, one has only to look at the latest Hootsuite & APCO worldwide data, according to which Facebook is the most dominant platform in the Middle East, with 180 million users, up from 56 million just five years ago. After studying 172 million interactions, Crowd Analyzer came to conclusion that Middle East’s youth were using social platforms to discuss brands, lifestyle, business & politics. One of the findings Twitter has the highest penetration globally in Saudi Arabia and Saudis use YouTube on a per capita basis more than any other country globally. 56% of MENA’s population –regularly use the Internet well above the world’s average and in some of the smaller GCC countries it is 90%.

As these digital behaviours get strengthened and reinforced in time, telecom companies will have to build new capabilities which would allow them to acquire and reach out to customers on these new digital channels.

While traditional acquisition channels like email, POS, & website content are efficient in their own right, they are not aligned to the digital needs of today’s customer who have a digital first agenda on their mind. For example, in today’s world where digital first companies like Amazon, Uber are bringing markets right into the customer’s home and on their mobile, why should the customer have to go to their retailer for something as simple as a top-up or a recharge?

In order to cater to these customers, telecom companies have to bring new capabilities like digital marketplace, IoT enablement, e-kyc, multi-channel management. A digital marketplace would allow the customer to add new services to their product from any device, any location at any time of their choosing. One of the roadblocks of MENA’s e-commerce is the lack of access to a broad and deep selection of products amply made clear by Souqs 8.4 million products compared to 550 million on Amazon. A digital marketplace enabled by telecom can work to overcome these limitations by bringing buyers and sellers of digital services on a single platform. Similarly, with the rise of voice assistants like Alexa, today’s digital first customers are getting things done through voice search. Telecom companies with a digital mindset can use this channel for streamlining customer acquisition. With IOT devices proliferating and reaching 1.1 billion connections in MENA, Telcos need to integrate their digital services with these for seamlessly acquiring and delivering digital services. As per Internet Trends Report 11% consumers purchase a product/service immediately after discovering it in social media and 44% purchase it later. Social media is driving both product discovery and purchase.

At the backend of every telecom service is distribution and fulfilment. An efficient system would consist of an ecosystem of motivated partners working efficiently, on time, driving value. Traditional distribution and fulfilment systems were built for a pre-digital world, with static workflows. Order raised in system would’ve to go through several hoops – supplier, whole-seller, retailer before getting fulfilled. However, in a digital world, where time is of essence, telcos need digital workflows to drive speed and innovation.

In this context, a digital supply chain would allow telecom operators to get a comprehensive, real time view of their business, which would help them in managing their business end to end while realizing new efficiencies and opportunities. In this digital ecosystem, telcos will new tools to manage partners, as a highly motivated and connected partner would become critical for their continuing growth. For example, a Fleet on street app (FOS) provides partners with the visibility to drive business efficiently. Similarly, with commissions defined in digital supply chain, commissions would be paid out in real time as soon as the sale is made motivating the partners to work even harder.

Customer service is critical to every enterprise. Over the years, telecom companies made massive investments in back offices, self-care apps, as well billing systems to improve the customer experience. However, the coming of the digital tide has changed the customer’s definition of service. Today’s customer wants to be serviced quickly, without any hassles. No one wants to talk to a customer service rep these days. Long wait times invariably lead to attrition. Also, the services have to be rendered intuitively, with each customer interaction improving iteratively basis learnings that were gleaned from the last interaction.

With the proliferation of virtual assistants telcos will have to make it easier for customers to service their requirements. With AI and Machine learning, telcos will be able to know their customers better and provide highly contextualized services catering to customer personas. By registering on social networking sites such as Twitter and Facebook, vendors explore new platforms to market their latest services, products, and solutions to gain public feedback and opinions.

Speaking of retention customer attrition is a lost investment for the telecom company, as it can cost 10 times more to bring a new customer than retaining one.

Rather than using rules based loyalty or churn management solutions, telcos should be looking at customer data for getting insights on their customers and reducing churn The best way to retain a customer is to keep him/her engaged. Improving recommended services is still a challenge and telcos are yet to match OTTs in this respect. OTT players like Netflix boast of their users consuming 8 of every 10 recommended content. Telcos need to deep dive into consumer behaviour and recommend services accordingly. To be able to reduce churn, telcos need to be ready with the next best option for a customer. The increased importance of sentiment analysis and the advances in text analytics are encouraging organizations to include social media in their business processes and help predict complex consumer behaviour and reduce churn and increase customer satisfaction; thereby increasing the lifetime value of a customer.

The below picture shows the modules Comviva has to offer for every stage of Digital Customer’s lifecycle:

Enabling block for CSP Transition

Consider how easy it is to book a cab for your destination on Uber and making the payments once you’ve reached your destination. Telecom providers aspiring to become digital service providers want to provide the same level of contextualization and personalization to their customers. However, the biggest roadblock coming in its way is the “chaos” and the “complexity” of the existing BSS systems that restrict its ability to launch digital services quickly and efficiently.

Since BSS upgrades are costly and time taking, the ‘big bang’ approach of transformation has seen to fail. This approach does not fit to serve the agile world in which we live, one where subscribers want everything personalized, now and on-demand.

Another favoured approach to digitization is to add new digital systems to support new digital services like Netflix etc. and new lines of business i.e. 5G, IOT etc. These new systems can be added as an overlay to existing legacy systems .The new add-on system can support a segment of customers initially and once stable can replace legacy system over time. This phased approach reduces the costs and risks involved in large scale transformations. By using this approach, operators can leverage a modular, micro-services driven approach and prioritize which service or “platform component” they need to replace first. This not only promotes faster service delivery but also reduces the cost and implementation timelines pertaining to digital transformation.

Looking into the future

While many of the operators have gone ahead with 5G trials the jury is still out on 5G usage cases like connected cars because of the long gap between investment cycle and the revenue cycle. However, in the interest of future proofing their business, the operators should invest in platforms that can be scaled for driving 5G usage cases of the future. Operators have to cautiously and judiciously roll out 5G and 5G based digital services in high dense urban areas and gradually move to other areas with specific use cases. As per GSMA survey, 85% of operators in 5G era will play the role of Platform and digital service providers and only 10% will play the role of sole connectivity providers.

Conclusion

Comviva believes that the classical telecom operator model has become a liability for operators in the Middle East. In order to recognize new opportunities in revenue and customer engagement, it has become imperative for the Middle East operators to drive linkages between customers, channels, products, digital services, technologies, locations and user segmentation. Over the years, Comviva has leveraged its ecosystem of partners to drive digital service for its client. Now, with its new digital capabilities, it is providing traditional telecom operators with the building blocks needed to become full digital service providers.