Industry Thought Leadership

Protecting Subscribers of Digital Services against Fraud

February, 2017Effectively protecting mobile content subscribers remains one of the major challenges facing telecoms.

As Mobile Subscribers purchase and consume content faster than ever before, the risk of being defrauded instantly increases as well. Most of the platforms used by carriers cannot provide instant and transparent information about mobile service subscribers. When problems arise, carrier customer support can take 48 hours and even longer to resolve subscribers’ requests. Rarely can the first line of telecom support provide an instant resolution to a subscriber’s problem. Receiving a refund is generally the subscriber’s primary objective, yet providing a refund often causes a big headache both for carriers and content providers.

RGK Mobile has built its Customer Care program on understanding and resolving subscribers’ problems within minutes of being alerted that a problem exists. RGK achieves this goal by better understanding fraudulent traffic sources and by having a clear complete picture of the whole chain of mobile subscription activation. We believe that the trend will be for more and more carriers to adopt business models that provide subscribers with the possibility of resolving their complaints, including the receipt of refunds, in minutes.

The current industry practice involves a chain of disparate entities between the subscriber and the carrier, including content providers, affiliates and aggregators. This leaves no single entity to which subscribers can easily turn with problems as they arise. The truth is that numerous disparate entities cannot be held accountable to subscribers or carriers because no one knows the real source of the problem.

When a content owner uses in-house advertising solutions, the small amount of attracted traffic will be mostly free of fraudulent elements. But it is impossible to cover all the traffic sources using a single department, as there are millions of sites and thousands of traffic brokers.

Currently, the highest traffic volume comes from websites, mobile sites and in-app advertising. Ads can be managed by content owners (if they have an in-house media purchasing department), and/or affiliates connected to the content owner.

So, if a content owner wants to seriously increase sales, he or she must turn to third-party affiliates. While most affiliates obviously do not engage in fraud, some do, and many more leave subscribers who made quick purchases containing hidden costs feeling as though they have been cheated. This risk of fraud or of subscribers feeling cheated will naturally increase as the number of affiliates increases.

Deceiving or even cheating subscribers is easy. Affiliates start with aggressive advertising. The potential subscriber, after making a click on a banner, goes through a chain of aggressive and often misleading pre-landings. When he arrives at the final landing page, totally approved and even hosted by the carrier, he pays little or no attention to the text and subscription conditions while opt-in. When that subscriber understands (usually within several days) that he has purchased an ongoing paid subscription, he becomes extremely dissatisfied and submits a complaint. He just wants to resolve his complaint urgently by canceling his subscription and getting a refund.

As uncontrolled fraud and deceptive practices multiply, the complaint volume rises quickly, leading carriers to think that all the 1click and other mobile services generate more headaches than money. But since the amount of money at stake is significant, carriers might make one last gambit to salvage their profits: to regulate the whole market themselves. They try to approve all the ads, asking to place subscription conditions right on the banners. Carriers might even ask to approve each traffic source, establishing penalties for each ad found on a non-approved source.

The amount of work that must be done to control every single banner and thousands of sites, though, is unimaginably high. Indeed, it is unmanageable. So carriers may try to impose penalties on affiliates, often in the tens of thousands of euros, for fraudulent traffic. But since all of these investments in traffic are by definition risky in the first place, affiliates prefer to stop advertising and to forget about the over-regulated market. It just isn’t worth it for them to deal with the heavy-handed management of the carriers.

The inevitable result is, of course, VAS income loss both for the carrier and all the other parties involved. The carrier might think that it has done the right thing by trying to regulate fraud on its own, but in fact it just does not have enough expertise and real market understanding to properly do so. Consider, for example, some of the problems that a carrier inexperienced in 1click might confront:

- Aggressive and misleading pre-landings;

- geographic traffic cloaking;

- time traffic cloaking;

- spam (email/sms/messengers/etc.);

- iframing;

- click-jacking;

- auto-subscriptions.

The carriers simply cannot meet this challenge alone.

Fortunately, RGK Mobile has developed a solution to solve the challenge posed by fraud and deceptive practices against mobile subscribers -- a solution that it is confident will become the industry trend for the future. It involves strong control by a single entity over content, affiliates and payment aggregation, providing one address for prompt response and resolution of problems.

The RGK Fraud Control Solution

RGK implements this solution using RGK Engine, its innovative, carrier-level content provider access platform.

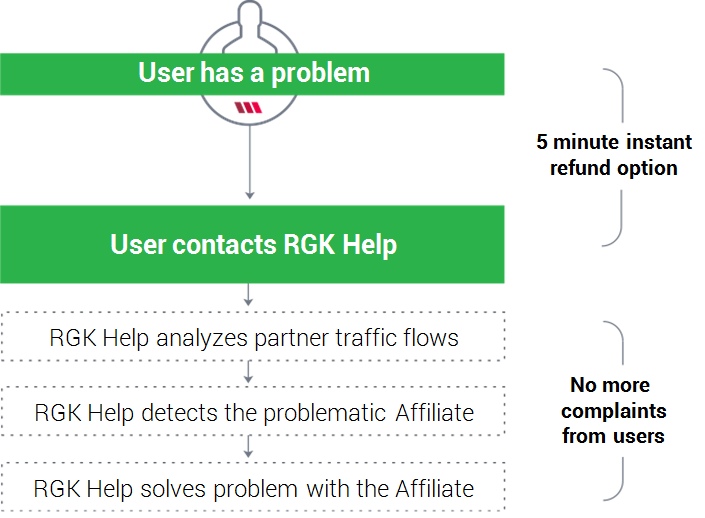

Strongly connected with and able to easily interact with RGK Help, customer support departments, RGK Engine provides a complete toolset to detect fraudulent traffic in real time.

Each affiliate partner of RGK uses special links for advertising which include a unique affiliate code, ensuring that each subscription is always associated with a particular partner and indeed with a specific traffic flow.

RGK Engine automatically gathers all the subscriber details such as IP address, referring source, device, and user-agent when the subscriber visits any RGK mobile services. Support department managers are able to get complete information about each subscriber in under a minute. When a subscriber calls, an RGK manager already sees all of the subscriber information while the subscriber is listening to the IVR welcome message.

Automated algorithms send alerts to the RGK team when the amount of complaints coming in for a specific partner’s traffic flow increases up to 1% of the total subscriptions made.

Once the team gets an alert, it might freeze the partner account in order to investigate the issue. All potential subscribers who click the partner’s advertising link will be redirected to localhost. The entire problem is solved in an hour or two, with no more new subscribers to the fraudulent campaign, and no more complaints.

RGK Help’s goal is to provide 24/7 support of the highest quality. To do so, RGK Help exercises full control of the process. Once it detects a problem, all the subscribers coming from an unreliable affiliate partner will be unsubscribed and receive an immediate refund.

Comparing the speed of problem resolution of RGK help with that of carrier support departments, we can confidently say that our solution is without peer, and we are certain that our integrated control of the process under one roof will become the industry standard in the future.

RGK Mobile is dedicated to always remaining at the cutting edge. For that reason, we have brought on board Ronald K. Noble, former Secretary General of INTERPOL, who brings his extensive experience in national and international law enforcement to assist us with our global strategy for preventing fraud and identifying patterns of fraud targeting mobile content subscribers.

RGK’s model will keep carriers and subscribers free from harm caused by affiliates employing fraudulent and deceptive practices. It is RGK’s belief that the trend for providing mobile content will be one of demanding greater protection of subscribers and greater accountability of all those in the chain of providing mobile content to subscribers. RGK believes that in the short-term, mid-term and long-term, everyone in the industry will benefit in terms of service, profit and reputation.