Industry Thought Leadership

LTE Roaming Study Underscores Importance of IPX in MEA

March, 2017LTE is growing globally, and growing fast, and in few other places in the world is it expected to grow more quickly than in MEA. Syniverse recently examined some of the ramifications of this at this year’s Mobile World Congress, where a study we released on LTE roaming patterns revealed some important implications for the development of LTE in MEA in the next few years.

MEA’s large population, surging mobile data use and lack of fixed-line internet connectivity promise a tremendous opportunity for LTE and rich mobile services in the next few years. From 2014 to 2020, for example, the GSMA projects that the percentage of mobile broadband connections will shoot from 34 to 69 percent just in MENA. Moreover, the lack of fixed broadband infrastructure means that the fixed-line stage of internet connectivity will largely be skipped, and many people will move directly to mobile for their method of going online.

Our study aimed to shed more light on this opportunity and across other key regions of the world. It analyzed the regular course, or “trade winds,” of global roaming traffic from across Syniverse’s customer base of more than 1,000 mobile operators, and it divided the traffic according to six regions: MEA; Asia Pacific (including Australia); India; Europe; North America (categorized as the U.S. and Canada for this study); and Latin America.

The study showed that while international roaming routes carry some traffic, a major part of the trade winds of inter-regional traffic exchange takes place within the Americas, to and from North America and Latin America. The biggest findings were as follows:

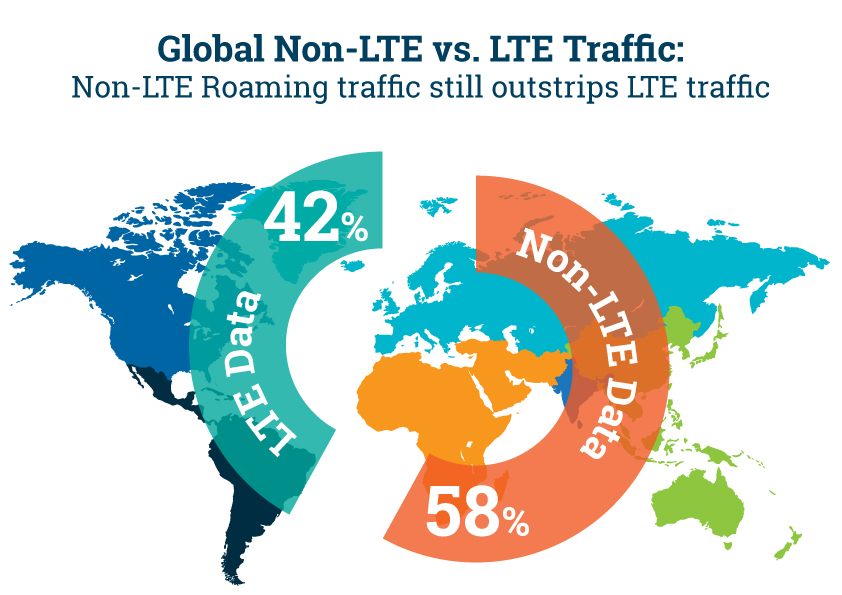

- Only 42 percent of inter-regional data roaming taking place around the globe is LTE, while non-LTE roaming traffic represents 58 percent.

- The overwhelming majority of inter-regional LTE roaming traffic – 81 percent – takes place between North America (U.S. and Canada) and Latin America.

In regard to MEA, these were the most important findings:

- In MEA, just 20 percent of total outbound data roaming volume is LTE traffic. On a related note, in Asia Pacific, a region thtat includes some of the world’s most advanced mobile networks, this volume is only 26 percent.

- Only 19 percent of MEA’s total inbound data roaming volume is LTE traffic. Similarly, for Europe, this number is just 21 percent.

Ultimately, the study revealed that as far as global LTE roaming, the tipping point hasn’t occurred yet, and, consequently, providing LTE roaming can be a critical differentiator for operators. Specifically, enabling LTE roaming is essential for operators to be able to capture revenue from 4G, and, later, 5G. As mobile users demand more rich experiences, operators need to prioritize LTE roaming, directly linking the value that the operator plays in that experience.

Importantly, our analysis found that while domestic LTE deployments have provided ample LTE capability to home subscribers and boosted intra-regional LTE roaming, the barrier to a truly global, consistent LTE experience lies in inter-regional connectivity that requires the versatile, secure network backbone that IPX provides. To this end, our data suggests that for routes across MEA and around the globe, operators need to develop a full-scale strategy for integrating IPX and accelerating the maturity of LTE networks.

In particular, IPX is critical for addressing two challenges with LTE network buildout. First, in addition to needing new equipment, new pricing structures and new roaming partnerships, operators that are expanding their 3G networks or launching 4G networks must focus on establishing reach to a maximum number of networks, so they can offer the widest coverage for their users. IPX has emerged as the most practical backbone for 3G, 4G and other next-generation services to allow operators to achieve this reach. Second, enabling ubiquitous roaming for these networks requires comprehensive testing of critical roaming processes, like clearing and settlement. IPX likewise provides a versatile platform for the enablement of this wide range of testing.

MEA will soon see a dynamic phase of mobile development with unprecedented demands for high-speed, high-capacity networks. As our study revealed, LTE roaming is still far from full maturity, and the barrier to this lies in inter-regional connectivity that requires the versatility and security of IPX. For this reason, it’s imperative that operators have a full-scale IPX strategy in place to meet the demands of the exciting future now shaping up in MEA.

To learn more about the study, visit http://visit.syniverse.com/global-lte-roaming-trade-winds/