AT&T Inc. (NYSE: T) reported strong third-quarter results that demonstrate continued customer demand for its nation-leading wireless and fiber offerings and position the Company to deliver on its full-year consolidated financial outlook.

“We have the key building blocks in place to give our customers the best connectivity experience in the industry and we’re winning the race to lead in convergence,” said John Stankey, AT&T Chairman and CEO. “We continue to add highly-profitable customers that are choosing AT&T for all their connectivity needs on the country’s fastest and largest wireless and fiber networks. It’s clear our differentiated investment-led strategy is working, and we remain on track to achieve all of our 2025 consolidated financial guidance.”

Third-Quarter Consolidated Results

- Revenues of $30.7 billion

- Diluted EPS of $1.29, which reflects a gain recognized on the sale of the DIRECTV investment, compared to $(0.03) a year ago, which included a non-cash charge

- Adjusted EPS* of $0.54, consistent with the year-ago quarter

- Operating income of $6.1 billion; adjusted operating income* of $6.6 billion

- Net income of $9.7 billion; adjusted EBITDA* of $11.9 billion

- Cash from operating activities of $10.2 billion, consistent with the year-ago quarter

- Capital expenditures of $4.9 billion; capital investment* of $5.3 billion

- Free cash flow* of $4.9 billion versus $4.6 billion a year ago

Third-Quarter Highlights

- Strong convergence strategy execution with over 41%1 of AT&T Fiber households also choosing AT&T Mobility

- 405,000 postpaid phone net adds with postpaid phone churn of 0.92%

- Mobility service revenues of $16.9 billion, up 2.3% year over year

- 288,000 AT&T Fiber net adds and 270,000 AT&T Internet Air net adds

- Consumer fiber broadband revenues of $2.2 billion, up 16.8% year over year

- Repurchased $1.5 billion in common shares; more than $2.4 billion repurchased through the third quarter under the 2024 authorization

- Closed the sale of remaining 70% stake in DIRECTV

- Announced purchase of low-band and mid-band spectrum from EchoStar for approximately $23 billion - covering virtually every market across the U.S.

Announced Transaction Highlights

The following includes a summary of recently announced transactions and expected financial impacts.

Acquisition of fiber assets from Lumen:

- Announced on May 21, 2025, an agreement to acquire substantially all of Lumen’s Mass Markets fiber internet connectivity business for $5.75 billion in cash, subject to purchase price adjustments.

- The transaction is now expected to close in early 2026, subject to certain regulatory and other customary closing conditions.

- AT&T will hold the acquired fiber network assets, including certain fiber network deployment capabilities, in a new, fully owned subsidiary (“NetworkCo”).

- After closing, the Company plans to sell partial ownership of NetworkCo to an equity partner that will co-invest in the ongoing business. AT&T expects to identify an equity partner and close a transaction within approximately 6-12 months of closing the Lumen transaction.

- In the 12-24 months following close, the impact of the transaction is expected to be immaterial to adjusted EBITDA*, adjusted EPS* and free cash flow*, and accretive over the long-term.

Acquisition of wireless spectrum licenses from EchoStar:

- Announced on August 26, 2025, the acquisition of approximately 30 MHz of nationwide 3.45 GHz mid-band spectrum and approximately 20 MHz of nationwide 600 MHz low-band spectrum for approximately $23 billion in cash, subject to certain adjustments.

- The transaction is expected to close in the first half of 2026, subject to certain closing conditions, including regulatory approvals.

- AT&T intends to finance the transaction with cash on hand and incremental borrowings.

- Following close, AT&T expects its net debt-to-adjusted EBITDA ratio* to increase to the 3.0x range and return to a level consistent with its leverage target in the 2.5x range within approximately three years.

- The Company does not expect a material impact to adjusted EPS* and free cash flow* during the first 24 months following close, with accretion to both metrics expected in the third year.

Outlook

AT&T reiterates all full-year 2025 financial guidance:

- Consolidated service revenue growth in the low-single-digit range.

- Mobility service revenue growth of 3% or better.

- Consumer fiber broadband revenue growth in the mid-to-high-teens.

- Adjusted EBITDA* growth of 3% or better.

- Mobility EBITDA* growth of approximately 3%.

- Business Wireline EBITDA* to decline in the low-double-digit range.

- Consumer Wireline EBITDA* growth in the low-to-mid-teens range.

- Capital investment* in the $22 billion to $22.5 billion range.

- Free cash flow* in the low-to-mid $16 billion range.

- Adjusted EPS* in the higher end of the $1.97 to $2.07 range.

- Share repurchases of $4 billion under the 2024 authorization.

AT&T continues to operate the business to achieve the strategy outlined at its 2024 Analyst & Investor Day and updated with its second quarter 2025 earnings release, including $20 billion of capacity for share repurchases during 2025-2027. Accordingly, AT&T reiterates its 2026-2027 financial outlook:

- Consolidated service revenue growth in the low-single-digit range annually from 2026-2027.

- Adjusted EBITDA* growth of 3% or better annually from 2026-2027.

- Adjusted EPS* accelerating to double-digit percentage growth in 2027.

- Capital investment* in the $23 billion to $24 billion range annually from 2026-2027.

- Free cash flow* of $18 billion+ in 2026 and $19 billion+ in 2027.

The Company expects to maintain a consistent approach to capital returns during 2028-2029 while reducing its net debt-to-adjusted EBITDA ratio*, supported by improved long-term growth in service revenue, adjusted EBITDA* and strong free cash flow* from the Lumen and EchoStar transactions.

Note: AT&T’s third-quarter earnings conference call will be webcast at 8:30 a.m. ET on Wednesday, October 22, 2025. The webcast and related materials, including financial highlights, will be available at investors.att.com.

Consolidated Financial Results

- Revenues for the third quarter totaled $30.7 billion versus $30.2 billion in the year-ago quarter, up 1.6%. This was due to higher Mobility, Consumer Wireline and Mexico revenues, partially offset by a decline in Business Wireline.

- Operating expenses were $24.6 billion versus $28.1 billion in the year-ago quarter. Operating expenses decreased primarily due to a $4.4 billion non-cash goodwill impairment in the prior-year quarter, lower expenses due to continued transformation initiatives and lower content licensing fees. These decreases were partially offset by increased equipment costs associated with higher wireless equipment revenues, approximately $0.4 billion of apportioned legal settlements, and higher network-related costs. Additionally, depreciation expense increased from continued fiber investment and network upgrades, which were partially offset by lower impacts from the Company’s Open RAN network modernization efforts.

- Operating income was $6.1 billion versus $2.1 billion in the year-ago quarter. When adjusting for certain items, adjusted operating income* was $6.6 billion, versus $6.5 billion in the year-ago quarter.

- Equity in net income (loss) of affiliates declined $0.3 billion versus the year-ago quarter, reflecting the completed sale of the remaining 70% stake in DIRECTV on July 2.

- Net income was $9.7 billion, including a $5.5 billion gain on the sale of the DIRECTV investment, versus $0.1 billion in the year-ago quarter, which included a $4.4 billion non-cash goodwill impairment.

- Net income attributable to common stock was $9.3 billion versus $(0.2) billion in the year-ago quarter. Earnings per diluted common share was $1.29 versus $(0.03) in the year-ago quarter. Adjusting for $(0.75), which excludes a gain on the sale of the DIRECTV investment, legal settlement costs, and other items, adjusted earnings per diluted common share* was $0.54, consistent with the year-ago quarter.

- Adjusted EBITDA* was $11.9 billion versus $11.6 billion in the year-ago quarter.

- Cash from operating activities was $10.2 billion. This was consistent with the year-ago quarter, which included the payment of termination fees associated with network modernization programs. Operational growth and lower cash tax payments in the quarter were more than offset by a voluntary pension plan contribution and lower distributions from DIRECTV.

- Capital expenditures were $4.9 billion versus $5.3 billion in the year-ago quarter. Capital investment* totaled $5.3 billion versus $5.5 billion in the year-ago quarter. Cash payments for vendor financing totaled $0.4 billion versus $0.2 billion in the year-ago quarter.

- Free cash flow* was $4.9 billion versus $4.6 billion in the year-ago quarter.

- Total debt was $139.5 billion at the end of the third quarter, and net debt* was $118.8 billion.

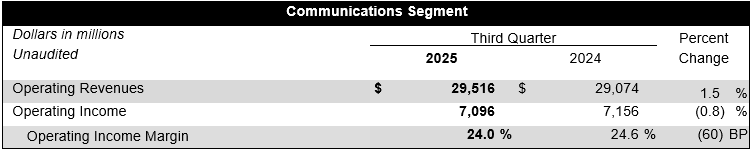

Segment and Business Unit Results

Communications segment revenues were $29.5 billion, up 1.5% year over year, with operating income down 0.8% year over year.

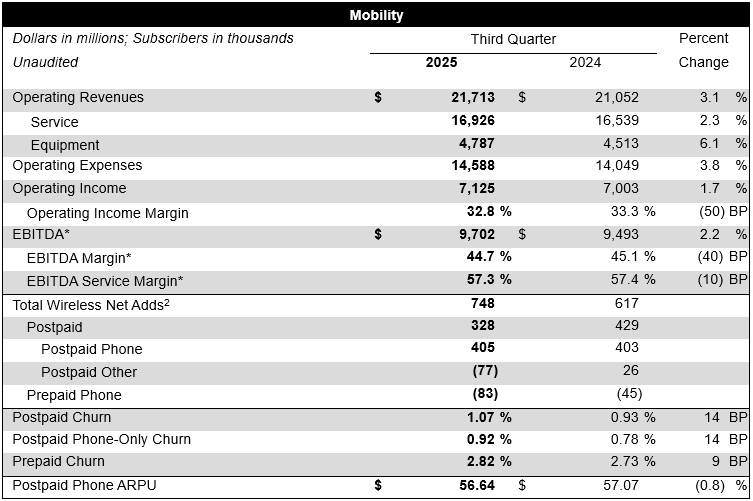

Mobility service revenue grew 2.3% year over year driving operating income growth of 1.7% and EBITDA* growth of 2.2%. Postpaid phone net adds were 405,000.

Mobility revenues were up 3.1% year over year, with service revenue growth of 2.3% and equipment revenue growth of 6.1%, driven by higher wireless device sales volumes. Service revenue growth reflects subscriber gains partially offset by promotional activity and the impact of one-time revenues of $90 million related to administrative fees in the prior-year quarter. Operating expenses were up 3.8% year over year, reflecting increased equipment expense due to higher wireless sales volumes and the sale of higher-priced devices as well as increased advertising and promotional costs and depreciation expense. These increases were partially offset by lower expenses due to continued transformation initiatives and lower content licensing fees. Operating income was $7.1 billion, up 1.7% year over year. EBITDA* was $9.7 billion, up $0.2 billion year over year.

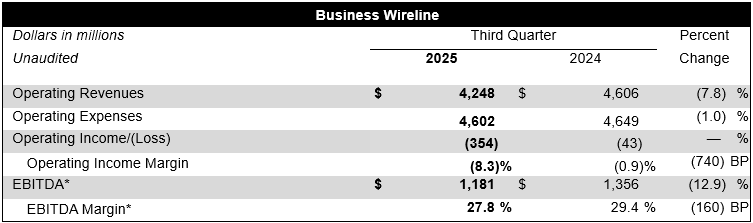

Business Wireline revenues declined year over year driven by continued secular pressures on legacy and other transitional services, which were partially offset by growth in fiber and advanced connectivity services.

Business Wireline revenues were down 7.8% year over year due to continued declines in legacy and other transitional services of 17.3%, partially offset by 6.0% growth in fiber and advanced connectivity services. Operating expenses were down 1.0% year over year due to lower personnel and customer support costs associated with ongoing transformation initiatives. These decreases were partially offset by favorable vendor settlements in the prior-year quarter and higher depreciation expense from ongoing strategic investment initiatives, such as fiber and AT&T Internet Air. Operating income was $(354) million versus $(43) million in the year-ago quarter. EBITDA* was $1.2 billion, down $0.2 billion year over year.

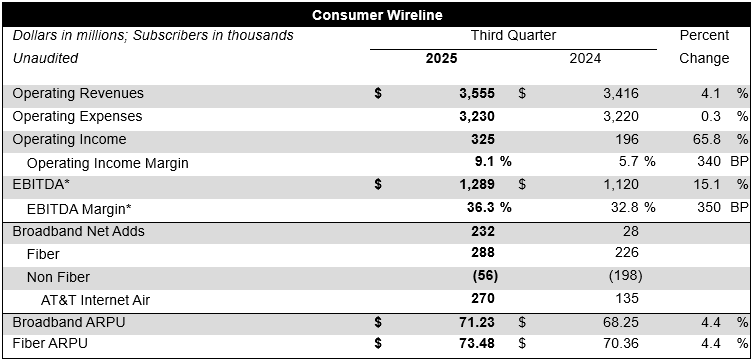

Consumer Wireline delivered strong broadband revenue growth driven by a 16.8% increase in fiber revenue. Consumer Wireline also delivered positive broadband net adds for the ninth consecutive quarter, driven by 288,000 AT&T Fiber net adds and 270,000 AT&T Internet Air net adds.

Consumer Wireline revenues were up 4.1% year over year driven by broadband revenue growth of 8.2% due to fiber revenue growth of 16.8%, partially offset by declines in legacy voice and data services and other services. Operating expenses were up 0.3% year over year due to higher depreciation expense driven by fiber investment and higher network-related costs. This was partially offset by lower content licensing fees, and customer support costs. Operating income was $325 million versus $196 million in the year-ago quarter. EBITDA* was $1.3 billion, up $0.2 billion year over year.

Latin America segment revenues were up 7.1% year over year, driven by subscriber and ARPU growth and higher equipment sales as well as the favorable impacts of foreign exchange rates. Operating expenses were up 6.0% due to higher equipment costs, selling costs, and bad debt expense resulting from higher sales, higher depreciation expense, and the unfavorable impacts of foreign exchange rates. Operating income was $22 million compared to $10 million in the year-ago quarter. EBITDA* was $199 million compared to $168 million in the year-ago quarter.