Page 12 - SAMENA Trends - July-August 2023

P. 12

REGIONAL & MEMBERS UPDATES SAMENA TRENDS

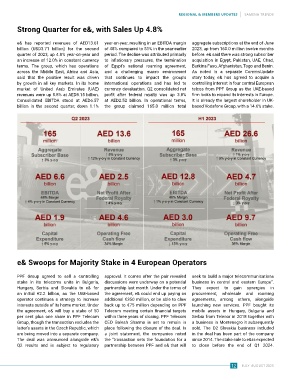

Strong Quarter for e&, with Sales Up 4.8%

e& has reported revenues of AED13.61 year-on-year, resulting in an EBITDA margin aggregate subscriptions at the end of June

billion (USD3.71 billion) for the second of 48% compared to 51% in the year-earlier 2023, up from 160.0 million twelve months

quarter of 2023, up 4.8% year-on-year and period. The decline was attributed primarily before. e& said there was strong subscriber

an increase of 12.0% in constant currency to inflationary pressures, the termination acquisition in Egypt, Pakistan, UAE, Chad,

terms. The group, which has operations of Egypt’s national roaming agreement, Burkina Faso, Afghanistan, Togo and Benin.

across the Middle East, Africa and Asia, and a challenging macro environment As noted in a separate CommsUpdate

said that the positive result was driven that continues to impact the group’s story today, e& has agreed to acquire a

by growth in all key markets. In its home international operations and has led to controlling interest in four central European

market of United Arab Emirates (UAE) currency devaluation. Q2 consolidated net telcos from PPF Group as the UAE-based

revenues were up 5.8% at AED8.15 billion. profit after federal royalty was up 3.8% firm looks to expand its interests in Europe.

Consolidated EBITDA stood at AED6.57 at AED2.52 billion. In operational terms, It is already the largest shareholder in UK-

billion in the second quarter, down 1.1% the group claimed 165.0 million total based Vodafone Group, with a 14.6% stake.

e& Swoops for Majority Stake in 4 European Operators

PPF Group agreed to sell a controlling approval. It comes after the pair revealed seek to build a major telecommunications

stake in its telecoms units in Bulgaria, discussions were underway on a potential business in central and eastern Europe”.

Hungary, Serbia and Slovakia to e& for partnership last month. Under the terms of They expect to gain synergies in

an initial €2.2 billion, as the UAE-based the agreement, e& could end up paying an procurement, wholesale and roaming

operator continues a strategy to increase additional €350 million, or be able to claw agreements, among others, alongside

interests outside of its home market. Under back up to €75 million depending on PPF launching new services. PPF bought its

the agreement, e& will buy a stake of 50 Telecom meeting certain financial targets mobile assets in Hungary, Bulgaria and

per cent plus one share in PPF Telecom within three years of closing. PPF Telecom Serbia from Telenor in 2018 together with

Group, though the transaction excludes the CEO Balesh Sharma is set to remain in a business in Montenegro it subsequently

latter’s assets in the Czech Republic, which place following the closure of the deal. In sold. The O2 Slovakia business included

are being moved into a separate company. a joint statement, the companies noted in the deal has been part of the company

The deal was announced alongside e&’s the “transaction sets the foundation for a since 2014. The stake sale to e& is expected

Q2 results and is subject to regulatory partnership between PPF and e& that will to close before the end of Q1 2024.

12 JULY-AUGUST 2023