FWA Info Series

FWA Market Updates & Trends

The Evolution of the FWA Ecosystem

Fixed Wireless Access (FWA) has emerged as one of the most successful and promising use cases for 5G technology. As of May 2024, GSA has identified announced 4G/5G FWA service offers from 562 operators in 188 countries and territories, and launched services from 493 operators in 176 countries and territories. Europe and the Middle East and Africa regions have the highest number of operators delivering FWA services using LTE or 5G. Notably, more than 50% of tariffs for LTE FWA are based on data volume, with speed-based structures favored by 19% of operators. The difference is less marked with 5G FWA. The average of the marketed maximum peak download speeds for LTE FWA was 178.6 Mbps, down from 180.5 Mbps in November 2023, based on data for 330 operators in May 2024. For 5G-based offerings, the average maximum peak download speed was 974 Mbps, down from 1,059 Mbps in November 2023 but still up from 875 Mbps in November 2022.

This indicates substantial growth and acceptance of the FWA technology in various markets. In fact, this success is partly attributed to the rapidly evolving ecosystem supporting 5G FWA. As the FWA technology matures, it offers increased flexibility and a broader range of monetization options for service providers. These advancements are helping operators address the growing demand for high-speed internet in areas where traditional fixed broadband is either unavailable or insufficient.

The Global Mobile Suppliers Association (GSA), which has been a crucial player in promoting the 3GPP ecosystem since its inception in 1998, is now a key force promoting FWA growth through its 4G-5G Fixed Wireless Access (FWA) Forum. The Forum serves as a platform for industry leaders to collaborate, share insights, and collectively advance the FWA ecosystem.

Market Update on Fixed Wireless Access (FWA)

Three key market developments are on the rise when it comes to FWA deployments:

- First, FWA deployment in rural and remote areas where traditional broadband infrastructure is simply nonexistent and is inadequate in view of worldwide digitalization trends. 5G FWA provides a cost-effective solution to bridge the digital divide, which means connectivity possibilities for close to one-third of the world’s still-unconnected population, offering high-speed internet access to underserved communities.

- Second, FWA deployment in urban areas through 5G home wireless solutions being offered at affordable prices, while attending to evolving consumer preferences. The success of this value proposition, however, is not merely in creating a new service but in fundamentally changing the dynamics of the home internet industry, at large.

- Third, rising reduced-capability (RedCap) FWA deployments that cater to IoT for both home and industrial applications, as well as consumer products, such as smart watches, wearable medical devices, AR/VR goggles, industrial wireless sensors, and video surveillance of premises.

One of the key areas where progress has been made but is further required, is advocacy for more spectrum in order to support the growing demand for wireless services. By working closely with regulatory bodies and industry stakeholders, associations such as the GSA and SAMENA Council, among others, are playing a pivotal role in shaping policies that foster the growth of FWA.

Advocacy and capacity-building go hand in hand. That is, in addition to advocacy, industry-wide educational activities to increase awareness and understanding of FWA technologies, such as through mediums like this “FWA Info Series” created by SAMENA Council, can make a dramatic impact on new decision-making approaches by providing valuable insights into the latest trends and developments concerning FWA, thus helping stakeholders stay informed and make informed decisions.

Comparative Analysis of 4G and 5G FWA

While both 4G and 5G technologies support FWA, there are significant differences in their capabilities and performance. 5G FWA offers much higher marketed speeds compared to its 4G counterpart, making it a more attractive option for both operators and consumers. However, it is important to note that end-user experiences can vary depending on several factors, including network conditions, quality of the deployed infrastructure and customer premises equipment (CPE), as well as the position of the CPE (indoor vs outdoor, near window, etc.).

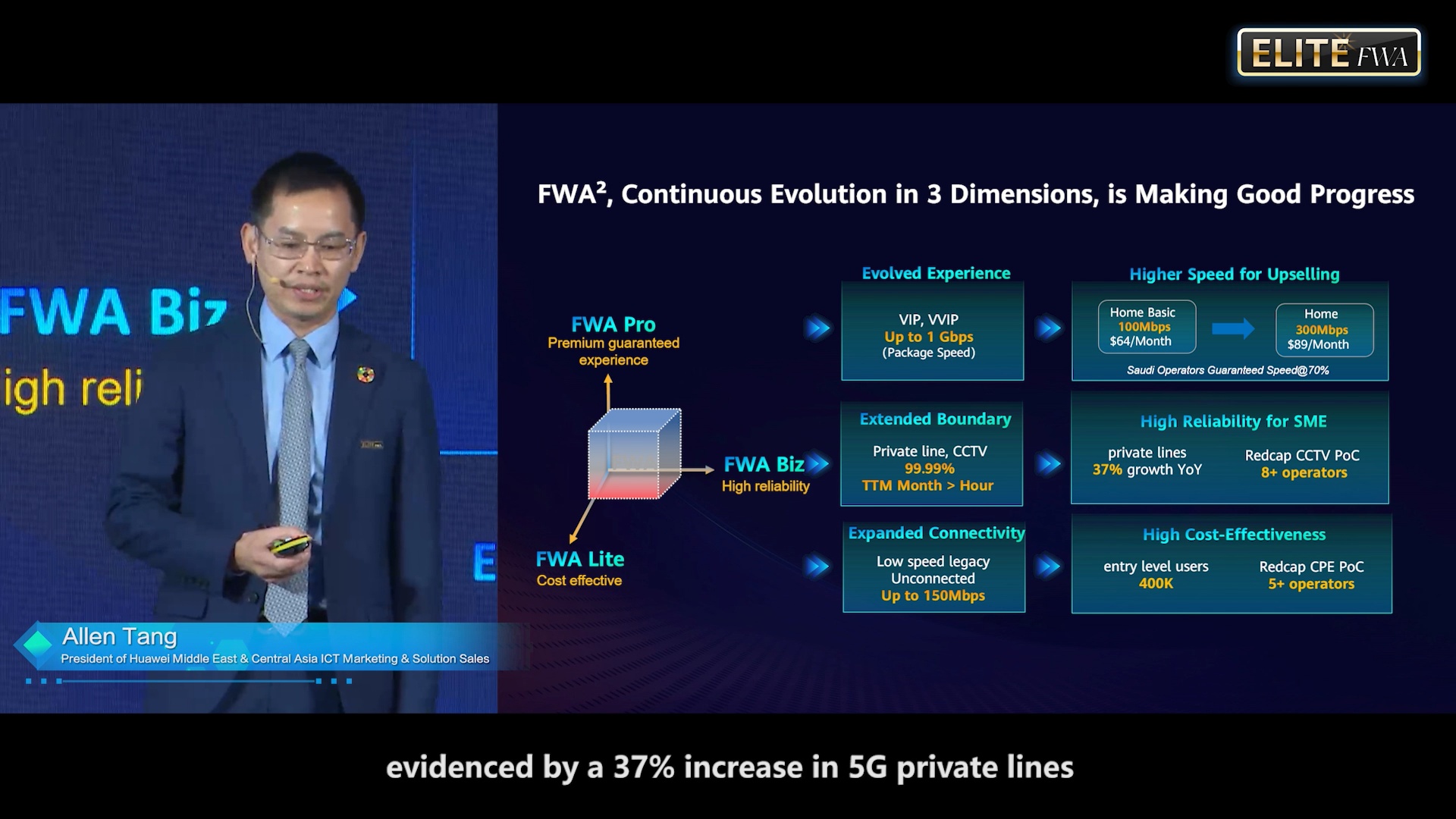

The focus in the FWA market is gradually shifting from merely providing high speeds to ensuring a superior end-to-end user experience. As a result, there is a growing emphasis on delivering guaranteed speeds to customers, aligning with the strategies traditionally used in fixed broadband services. Another emerging approach being adopted in the 5G FWA space is the introduction of speed-based tariffs. This approach allows operators to offer tiered pricing based on the speed of service provided, which is similar to how fixed broadband services are monetized. This strategy not only provides more flexibility for consumers but also opens new revenue streams for service providers.

Ecosystem and Market Segmentation

The GSA conducts annual surveys with its CPE (Customer Premises Equipment) members to gather strategic information on various aspects of the FWA market, including shipment trends and geographic distribution. These surveys provide valuable data that helps industry stakeholders understand the current state of the market and identify potential growth areas.

One of the key findings from recent surveys conducted shows an expected doubling of 5G device shipments in the near future. This growth is largely driven by the increasing adoption of millimeter wave (mmWave) technology in regions, such as North America, whereas in the SA-ME-NA, Central Asia, and neighboring regions, it is the large scale of the addressable market and FWA being the largest use-case to monetize 5G investments, as well as the use of C-band and 2.6 GHz frequency bands, which are driving FWA growth. While dynamics may differ, the growth trend is anticipated to follow an upward trajectory across all regions.

- FWA is one of the most successful 5G use-cases, with more than 152 operators currently offering 5G FWA services.

- The ecosystem for 5G FWA is rapidly developing, providing more flexibility and monetization options.

- 5G FWA offers much higher marketed speeds compared to 4G, although end-user experiences may vary.

- The focus is shifting from speed to end-to-end user experience and guaranteed speeds.

- There is a growing trend towards speed-based tariffs for 5G, aligning with fixed broadband monetization strategies.

- The market for 5G device shipments is expected to double, with significant growth in millimeter wave technology.

- FWA offers an experience comparable to Fiber-based broadband, combining rapid deployment advantage and cost efficiencies.

- From the business perspective, primary benefits of FWA lie in its rapid deployment, reduced initial costs, and a shorter period to achieve return on investment (ROI). From the consumer perspective, competitive pricing, seamless purchase journey, and adequate network speeds are key differentiators of FWA.

- Observations show that nearly a quarter of the FWA users have transitioned or are likely to transit from Fiber services even in regions with established Fiber infrastructure.

- Overcoming the preference for optical-fiber connections in markets with high Fiber availability, requires FWA service providers to be creative and innovative.

Successful FWA Implementation around Regions

Several operators have successfully implemented 5G FWA to enhance their service offerings and compete with traditional fixed broadband providers, including du, stc Kuwait, to name a few Operators closely associated with SAMENA Council.

du invested heavily in expanding their 5G infrastructure, offering potential customers the freedom to choose wireless broadband anywhere in the country. Gaining the trust of customers who were accustomed to fiber connections was crucial. du’s 4G Home Wireless product laid the foundation, showcasing reliability and competitive pricing, which piqued the interest of many. du’s approach of showcasing reliability and competitive pricing with their 4G Home Wireless product laid a solid foundation. With 5G, du enhanced data speeds and reduced latency, ensuring an even more remarkable user experience.

stc Kuwait, immediately after launching its 5G-based home broadband, introduced the Middle East's first 5G Dedicated Internet Access (DIA) service for businesses, enabling enterprises to harness the power of 5G to accelerate digital transformation initiatives. This pioneering move underscored stc Kuwait's dedication to driving economic growth and empowering organizations with cutting-edge connectivity solutions, including through Fixed Wireless Access and IoT. stc’s 5G reduced capability (RedCap) FWA service is now delivering robust and consistent internet speeds, catering to the digital needs of Kuwaiti citizens and businesses, and ranks among strong FWA deployment scenarios.

Three UK, for example, has effectively utilized 5G FWA to position itself as a strong competitor in the broadband market. By offering high-speed wireless services, Three UK has been able to challenge the dominance of fixed broadband providers and advocate for FWA as a viable complement to fiber-based services.

Similarly, Telia Norway has integrated FWA into its service portfolio, using it alongside fiber to provide comprehensive connectivity solutions. This approach has resulted in high customer satisfaction, as it offers the flexibility of wireless access without compromising on speed or reliability. Telia Norway continues to evolve its offerings, leveraging the strengths of both FWA and fiber to meet the diverse needs of its customers.

Conclusion

As the FWA market continues to grow, its importance in the 5G landscape becomes increasingly evident. The advancements in technology, coupled with strategic initiatives by industry organizations are driving the rapid development of the FWA ecosystem.

Adoption of FWA needs to be accelerated, not only from convenience, capability, and monetizable use-case points of view, but also from the fact that FWA and Fiber are two technologies that can greatly complement each other to empower a strong operations and business strategy by Telecom Operators in the SA-ME-NA and Central Asia region, and beyond. Unique advantages of FWA and Fiber should be capitalized on with the co-existence mindset, which can allow for catering to diverse market needs, end-user demands, and various regional considerations from policy to geographical perspectives. As FWA evolves, so will the overall digital ecosystem in these regions.

To learn more for latest information: https://gsacom.com/paper/fwa-market-june-2024/