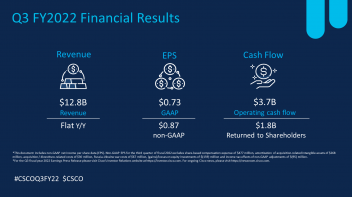

Cisco reported third quarter results for the period ended April 30, 2022. Cisco reported third quarter revenue of $12.8 billion, net income on a generally accepted accounting principles (GAAP) basis of $3.0 billion or $0.73 per share, and non-GAAP net income of $3.6 billion or $0.87 per share.

"We continued to see solid demand for our technologies and our business transformation is progressing well," said Chuck Robbins, chair and CEO of Cisco. "While Covid lockdowns in China and the war in Ukraine impacted our revenue in the quarter, the fundamental drivers across our business are strong and we remain confident in the long term."

"We delivered healthy earnings despite unanticipated disruptions through strong pricing and disciplined spend management," said Scott Herren, CFO of Cisco. "Our product backlog is well over $15 billion and product ARR and RPO again grew double digits. The continued progress in our business model transformation reflects the success of our strategy and underpins our long-term confidence."

|

GAAP Results |

||||||

|

Q3 FY 2022 |

Q3 FY 2021 |

Vs. Q3 FY 2021 |

||||

|

Revenue |

$ 12.8 billion |

$ 12.8 billion |

—% |

|||

|

Net Income |

$ 3.0 billion |

$ 2.9 billion |

6% |

|||

|

Diluted Earnings per Share (EPS) |

$ 0.73 |

$ 0.68 |

7% |

|||

|

Non-GAAP Results |

||||||

|

Q3 FY 2022 |

Q3 FY 2021 |

Vs. Q3 FY 2021 |

||||

|

Net Income |

$ 3.6 billion |

$ 3.5 billion |

3% |

|||

|

EPS |

$ 0.87 |

$ 0.83 |

5% |

|||

The third quarter of fiscal 2022 had 13 weeks compared with 14 weeks in the third quarter of fiscal 2021.

Reconciliations between net income, EPS, and other measures on a GAAP and non-GAAP basis are provided in the tables located in the section entitled "Reconciliations of GAAP to non-GAAP Measures."

Financial Summary

All comparative percentages are on a year-over-year basis unless otherwise noted.

Q3 FY 2022 Highlights

Revenue -- Total revenue was flat at $12.8 billion, with product revenue up 3% and service revenue down 8%. Revenue by geographic segment was: Americas up 5%, EMEA down 6%, and APJC down 6%. Product revenue performance was led by growth in Secure, Agile Networks up 4%, Internet for the Future up 6%, End-to-End Security up 7%, and Optimized Application Experiences up 8%. Collaboration was down 7%.

The third quarter of fiscal 2022 had 13 weeks compared with 14 weeks in the third quarter of fiscal 2021. The total additional revenue associated with the extra week in the third quarter of fiscal 2021 was approximately 3% of revenue growth.

In March 2022, in connection with the Russian invasion of Ukraine, Cisco announced its intention to stop business operations in Russia and Belarus for the foreseeable future. The total negative impact to revenue was approximately $200 million in the third quarter of fiscal 2022. Historically, Russia, Belarus and Ukraine collectively, represented approximately 1% of our total revenue.

Gross Margin -- On a GAAP basis, total gross margin, product gross margin, and service gross margin were 63.3%, 61.8%, and 67.3%, respectively, as compared with 63.9%, 62.6%, and 67.4%, respectively, in the third quarter of fiscal 2021.

On a non-GAAP basis, total gross margin, product gross margin, and service gross margin were 65.3%, 64.1%, and 68.9%, respectively, as compared with 66.0%, 64.9%, and 68.7%, respectively, in the third quarter of fiscal 2021.

Total gross margins by geographic segment were: 64.8% for the Americas, 65.9% for EMEA and 66.4% for APJC.

Operating Expenses -- On a GAAP basis, operating expenses were $4.5 billion, down 4%, and were 35.1% of revenue. Non-GAAP operating expenses were $3.9 billion, down 5%, and were 30.7% of revenue.

Operating Income -- GAAP operating income was $3.6 billion, up 4%, with GAAP operating margin of 28.1%. Non-GAAP operating income was $4.5 billion, up 4%, with non-GAAP operating margin at 34.7%.

Provision for Income Taxes -- The GAAP tax provision rate was 19.9%. The non-GAAP tax provision rate was 19.0%.

Net Income and EPS -- On a GAAP basis, net income was $3.0 billion, an increase of 6%, and EPS was $0.73, an increase of 7%. On a non-GAAP basis, net income was $3.6 billion, an increase of 3%, and EPS was $0.87, an increase of 5%.

Cash Flow from Operating Activities -- $3.7 billion for the third quarter of fiscal 2022, a decrease of 6% compared with $3.9 billion for the third quarter of fiscal 2021.

Balance Sheet and Other Financial Highlights

Cash and Cash Equivalents and Investments -- $20.1 billion at the end of the third quarter of fiscal 2022, compared with $24.5 billion at the end of fiscal 2021.

Remaining Performance Obligations (RPO) -- $30.2 billion, up 7% in total, with 54% of this amount to be recognized as revenue over the next 12 months. Product RPO were up 13% and service RPO were up 3%.

Deferred Revenue -- $22.3 billion, up 7% in total, with deferred product revenue up 13%. Deferred service revenue was up 2%.

Capital Allocation -- In the third quarter of fiscal 2022, we returned $1.8 billion to stockholders through share buybacks and dividends. We declared and paid a cash dividend of $0.38 per common share, or $1.6 billion, and repurchased approximately 5 million shares of common stock under our stock repurchase program at an average price of $54.20 per share for an aggregate purchase price of $252 million. The remaining authorized amount for stock repurchases under the program is $17.6 billion with no termination date.

Acquisitions

In the third quarter of fiscal 2022, we closed the acquisition of Opsani, a privately held enterprise software company.

Guidance

Cisco expects to achieve the following results for the fourth quarter of fiscal 2022:

|

Q4 FY 2022 |

||

|

Revenue |

(1)% - (5.5)% decline Y/Y |

|

|

Non-GAAP gross margin rate |

64% - 65% |

|

|

Non-GAAP operating margin rate |

31.5% - 33.5% |

|

|

Non-GAAP EPS |

$0.76 - $0.84 |

Cisco estimates that GAAP EPS will be $0.60 to $0.70 for the fourth quarter of fiscal 2022.

Cisco expects to achieve the following results for fiscal 2022:

|

FY 2022 |

||

|

Revenue |

2% - 3% growth Y/Y |

|

|

Non-GAAP EPS |

$3.29 - $3.37 |

Cisco estimates that GAAP EPS will be $2.75 to $2.85 for fiscal 2022.

Our fiscal 2022 has 52 weeks compared with 53 weeks in fiscal 2021 which is reflected in the guidance.

Our Q4 FY 2022 and FY 2022 guidance assumes an effective tax provision rate of 19% for GAAP and non-GAAP results.

A reconciliation between the Guidance on a GAAP and non-GAAP basis is provided in the tables entitled "GAAP to non-GAAP Guidance" located in the section entitled "Reconciliations of GAAP to non-GAAP Measures."